Turning Market Volatility into Opportunity: Smart Strategies for Investors

28 Aug 2025

In a financial landscape defined by elevated volatility, wobbly global economic signals, and shifting investor sentiment, the savvy investor doesn’t retreat—they adapt. The recent months of 2025 have been fertile ground for strategic opportunity, as market swings offer both warnings and entry points. From disciplined diversification to active tactical plays, here's a fresh and comprehensive guide for turning market turbulence into long-term gains.

Embrace Diversification—Across Markets, Assets, and Styles

True resilience begins with spreading risk:

- Asset class diversity remains key. Bonds are making a comeback, offering much-needed stability and income even amid equity volatility Hennion & Walsh+5eToro+5Barron's+5arXiv+1.

- Global exposure offers added strength. Markets in Europe, Latin America, and India have outperformed U.S. equities so far in 2025, highlighting the benefit of a geographically diversified portfolio AP News.

- Alternative assets are gaining traction. Gold, buoyed by de-dollarisation trends and growing institutional demand, has surged—making it a compelling 5–10% portfolio consideration via bullion or ETFs.

Revisit the Classics: 60/40 and Active Management

- The classic 60/40 portfolio (stocks-bonds) is showing renewed relevance—especially as falling rates could lift bond returns, making longer-duration bonds more appealing Axios.

- Hedge funds, particularly macro and active equity pickers, are staging a comeback. BlackRock recommends raising allocations by up to 5 percentage points, citing strong recent performance and the need for flexible strategies in uncertain times.

- Notably, stock picking hedge funds—especially long-short equity managers—have drawn in $10 billion this year, demonstrating their ability to navigate volatility more effectively than passive approaches.

Defensive Plays and Tactical Positioning

With caution looming, strategic defence matters:

- Defensive sectors like healthcare and consumer staples offer shelter as markets face red flags such as elevated margin debt, concentrated leadership, and declining liquidity.

- As volatility-control funds may have saturated the U.S. equities market, some strategists urge reducing exposure and increasing global diversification, noting parallels to past overbought conditions MarketWatch.

Tactical and Aggressive Tools for Volatility Hunters

For skilled investors, volatility isn't just a threat—it’s an opportunity:

- Leveraged and inverse ETFs provide magnified exposure (both upward and downward), suitable for short-term tactical bets—with risk management essential.

- Sector rotation—moving among sectors based on economic cycles—is proving effective. Tech, utilities, and others dominate at different stages MarketWatch+5Investopedia+5MarketWatch+5.

- Short-selling or inverse ETFs let investors profit from declines—though these require precision and discipline Investopedia.

- Swing trading benefits from short-term trends in liquid ETFs, offering potentially nimble returns Investopedia.

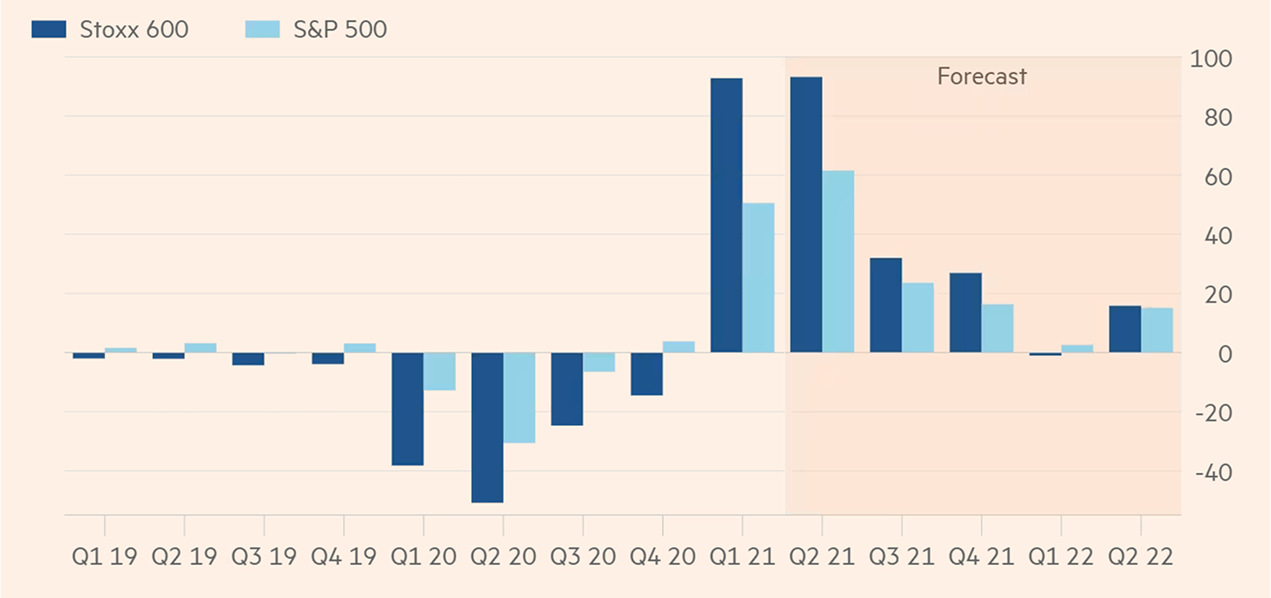

Q1 2025 data represents a blend of estimates and actual reported earnings

Source: Refinitiv

Preventing Pitfalls: Avoiding Common Investor Errors

Even the best strategies can falter if foundational mistakes are made:

- Don’t chase trends blindly. Herd behaviour and influencer-driven trades often lead to poor outcomes Kiplinger.

- Market timing is perilous. Missing just a few big rebound days can severely dent long-term performance.

- Over concentration is risky. Relying on a narrow set of assets, like cryptocurrencies or a handful of tech names, increases volatility exposure.

- Take profits and rebalance. Holding winners indefinitely can leave investors vulnerable to sudden reversals.

- Stay patient. Volatile periods test discipline—but long-term perspective consistently wins.

Plan for the Unexpected: Crisis Preparedness

- Stress-test your portfolio against black swan events—think wars, pandemics, or geopolitical shocks—to assess resilience.

- Diversify beyond popular assets. Equity megacaps may dominate headlines, but real protection may lie in broader, less crowded holdings.

- Keep contingency liquidity ready. Access to cash during market chaos provides flexibility and peace of mind.

Final Thoughts

As of August 27, 2025, markets remain dynamic but offer pathways for astute investors. By thoughtfully combining diversification, tactical acuity, disciplined execution, and crisis planning, volatility becomes a tool—not a foe. Whether leaning into global equities, gold, hedge funds, or defensive sectors, the right mix can transform market tremors into opportunity.

Let me know if you'd like this article tailored to specific investor profiles (e.g., retail, institutional), market regions, or time horizons.